Stocks declined last week as incoming data showed that inflation may have reversed course and adjusted market expectations around further Fed rate hikes this year. On Friday, the Commerce Department reported that its core (less food and energy) personal consumption expenditures (PCE) price index jumped 0.6% in January, above expectations of an increase of 0.4% and its most significant rise since August.

The S&P 500 suffered its worst weekly loss since early December, dropping 2.7%. As of Friday’s close, the index had surrendered roughly 35% of the rally that began in October, but it remained up 3.40% for the year. The Dow lost 3% and fell into negative territory for 2023, while the Nasdaq sank 3.3%.

On paper, this week’s first featured company should be reeling from the pressures impacting the consumer economy, but its brand remains as powerful as ever. The stock is a favorite among hedge funds, and it garners a Strong Buy rating from the Wall Street pros.

Apple (AAPL)

Apple’s greatest strengths center on its operational dominance. For instance, its three-year revenue growth rate is 20%, beating out 85.62% of its competitors. Its net margin pings at 24.56%, outpacing 95.52% of rivals. Currently, Wall Street analysts peg AAPL as a consensus Strong Buy. Further, their average price target stands at $171.94, implying over 15% upside potential.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”AAPL” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

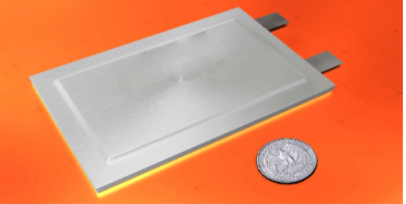

QuantumScape (QS)

QuantumScape has shipped prototypes to automakers, who are in the process of testing its breakthrough batteries. Due to the nature of the companies’ agreements, the company can’t disclose any testing details. But it has been said that the tests are going well, which will likely translate to a smooth operational ramp over the coming quarters. Plus, QuantumScape is excelling when it comes to cutting costs and managing cash; it extended its runway to 2025 when commercial operations are expected to start.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”QS” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Match Group (MTCH)

The pandemic provided a bump in online dating and sent MTCH stock price soaring, reaching its ATH of around $169 in October 2021. Since the share price has lost nearly 75% of its value, but the global, fundamental need to meet people isn’t going anywhere. Match benefits from inelastic demand, compared to other consumer discretionary names, which the company intends to continue capturing with its technologies, including Tinder, OkCupid, and Hinge providing a solid and resilient subscription-based business. MTCH has a consensus Buy rating. A $60.23 price target implies a 38% upside.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”MTCH” start_expanded=”true” display_currency_symbol=”true” api=”yf”]