When stock prices are low, focus on the future.

The first half of 2022 had the dubious distinction of ending with the largest market loss on record in more than 50 years. For investors used to the recent bull market, this can feel like a blow. But time and time again, the stock market has always returned to gains after a bear market and surpassed previous highs.

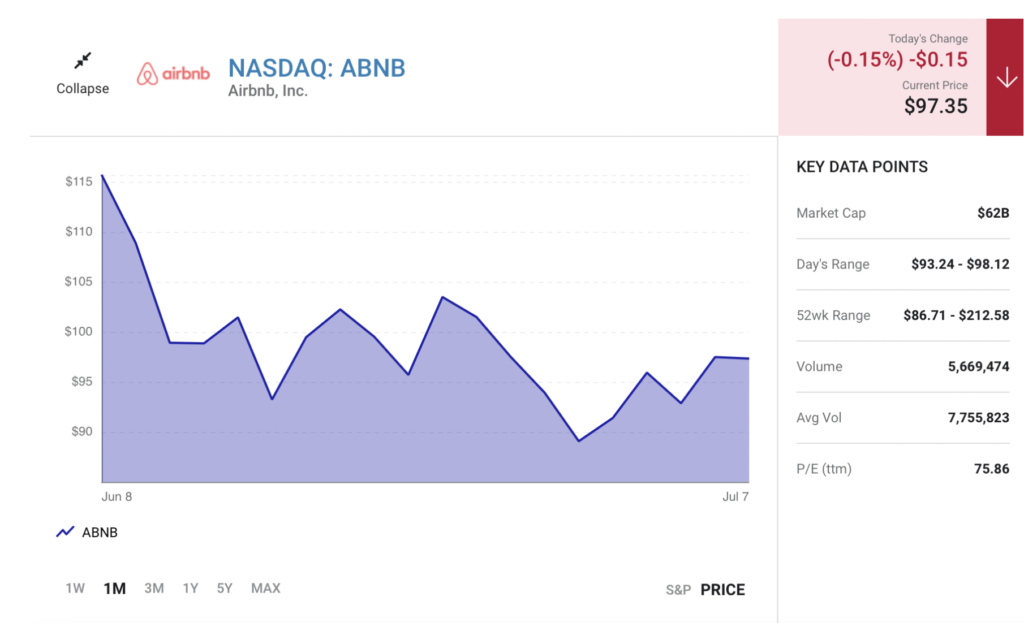

It’s a good reminder to focus on high-quality companies that should easily bounce back when the market does, providing many years of gains for your portfolio. Shopify (SHOP 0.68%), Airbnb (ABNB -0.15%), and Floor & Decor Holdings (FND -1.23%) are three stocks trading at low prices that can help set you up for life.

1. Shopify

E-commerce giant Shopify has been under a lot of pressure lately, and its stock is now down 76% this year. It’s not a great time for tech or retail stocks. The market has little appetite for highly valued growth stocks, and it sees short-term pressure for anything connected to retail. Investors are eschewing upstarts and companies that aren’t profitable in favor of solid value stocks that can outlast any recession.

Internally, the company is dealing with falling demand after the early pandemic rush. This is impacting its business in two important ways. One, revenue growth sharply decelerated in the 2022 first quarter to 22% year over year. The other is that management is upping its marketing spending, which is affecting the bottom line. Shopify posted a massive $1.5 billion loss in the first quarter after many quarters of profitability, especially when sales shot up last year.

There may be more of that in the future based on Shopify’s recent announcement that it’s acquiring delivery company Deliveroo for more than $2 billion. That will take a chunk out of its earnings, but it’s an effort to build up its e-commerce capabilities, which is expected to result in higher merchant sign-ups and overall higher sales and earnings down the line.

E-commerce is expected to keep growing at a fast clip and reach $5.55 trillion this year. The percentage of worldwide sales made online this year is expected to reach 21% of all sales, up from 17.9% two years ago, and it’s expected to reach 24.5% by 2025. Shopify is investing in its future and capturing more share of this growing market. Buying Shopify stock now can help set up your portfolio for life.

2. Airbnb

Airbnb didn’t benefit from any early-stage pandemic orders; quite the opposite. It suffered double-digit sales declines and yet was still the largest initial public offering of 2020 at the same time. It was a very different kind of

Despite the astronomical valuation at the time, Airbnb is a company that’s more than hype. It has bounced back with high sales even while travel hasn’t yet completely resumed. It’s surpassed its pre-pandemic sales levels and has posted several profitable quarters.

It’s well-positioned to continue to post sales growth in this atmosphere as well as into the future, and it’s constantly upgrading to make that happen. It just launched a highly anticipated “summer release” with 100 upgrades to various aspects of its service, and that follows a release last year with 150 improvements.

It’s the company’s agility that’s a major element of its success. It was able to recruit more hosts and offer more non-urban locations when travel became difficult, but it won’t be stuck with them after, unlike many retailers who are stuck with excess inventory. It can meet demand wherever it is, literally and figuratively.

Airbnb stock is down 44% this year, but it has tremendous growth opportunities.

3. Floor & Decor

There’s so much to like about Floor & Decor, both as a store and a stock. Warren Buffett noticed that as well, picking up some shares for Berkshire Hathaway.

It’s fairly new, in operation since 2020, and pretty small, with 166 stores and five design centers in 33 states. Even though it has a fairly niche focus in flooring and complementary products, when you think about there being more than 2,300 Home Depot stores and counting, it seems like the growth opportunity is huge.

So far, it’s done great work in its existing locations. It offers everything a shopper for its products might need, with “visually inspiring” layouts, free design services, and a strong omnichannel model. Customers appreciate its low prices. It opened 27 stores in 2021 to reach 160, nearly double the count from five years ago, and it sees the potential for at least 500 stores.

2022 first-quarter sales increased 31% year over year to top $1 billion for the first time, although net income decreased as the company dealt with the same increased costs as the rest of the retail industry.

This is a simple and winning model, but the stock is down 47% this year. The shares are now trading at 25 times trailing 12-month earnings, which seems like a good value for a stock with its potential. At this price, there should be many years of growth ahead for shareholders.